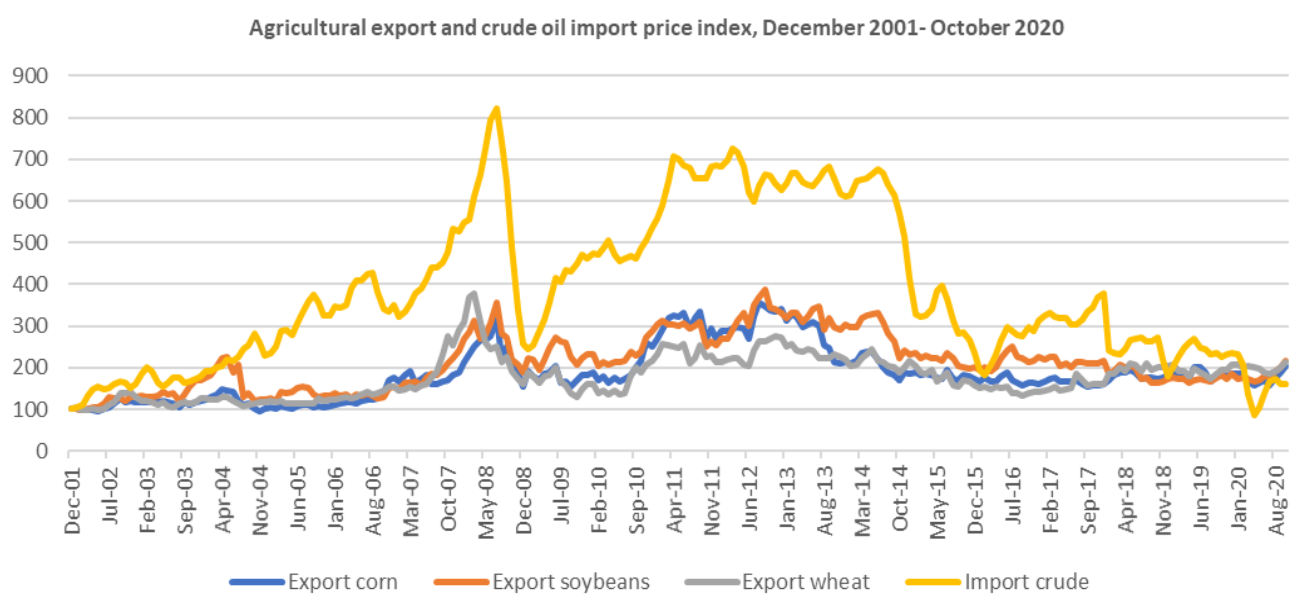

Many people and animals around the world depend on agricultural commodities (corn, soybeans, rice, and wheat) as their main food sources. United States is the biggest exporter of some of these essential commodities (36 percent of global corn, almost 40 percent of global soybean, 16 percent of world wheat production). The export prices of these commodities change more frequently and unpredictably than U.S. export prices in general. The figure below shows how the prices of corn, soybeans , wheat exports, and crude oil imports have fluctuated over time.

Agricultural Export and Oil Import 2001 - 2020 Source:U.S. Bureau of Labor Statistics

During the period shown in the above chart, the graphs for export corn, soybeans, and wheat reveal prices subject to volatility—in other words, recording large price changes on 1- or 12-month bases.

Agricultural goods prices are unstable because they depend on weather events, crude oil price changes, and the value of the U.S. dollar. Moreover, the prices of some of these commodities (corn, soybeans, and wheat) usually move together because they have similar factors that affect their prices, such as substitutability, demand, biofuels, the value of the U.S. dollar, weather, and crude oil. The increased connection between energy and non-energy commodity prices, strong demand by developing countries and changing weather patterns will be the main forces that are likely to influence developments in commodity markets. Using Data, time series, and signal mining of common price determinants of the commodities would give farmers foresight and/or prediction to help them maximize their profits. The commodities prices have a direct impact on farm profitability and sustainability of small farmer and machine learning algorithms would help farmers to cope with price shocks.

Commodity Price prediction is vital to local, national, and global economy. It would be better to regulate commodity pricing to consumers and help small farmers to have sustained agriculture. Inherently, commodity prices data is a time series data. Regression Models, Zero-Inflated Poisson Regression Models, Time Series, and other ML Models help to predict commodity prices. Hanumayamma Data Science and Agriculture Analytics Platform apply series of Statistical, Machine Learning, and Mathematical Optimization Models to enable small farmers’ head of trends of changing commodity market swings and promise to preserve and protect farm inputs!

Case Studies

List of successful case studies from our customers:

Food Industries

Food Industries Coca-Cola partnered with Hanumayamma to deploy an AI-driven Mango Yield, Harvest Calendar, and Supply Chain Platform that forecasts yield, predicts prices, maps global harvests, and optimizes sourcing—reducing costs, stabilizing procurement, and preventing disruptions.

Small Farmers & Producers

Small Farmers & Producers Hanumayamma Innovations empowers farmers with AI + IoT sensors that deliver real-time cattle health insights, boost productivity, reduce mortality, and strengthen rural decision-making. By building trust, transparency, and digital access, we help create resilient, climate-smart, future-ready dairy systems.

Banks & Insurance Companies

Banks & Insurance Companies Hanumayamma’s AI-powered Cow Necklace Sensors help development banks reduce dairy-loan risks by monitoring cattle health, preventing losses, improving insurance accuracy, boosting productivity, and enabling real-time digital loan oversight.

State & Local governments

State & Local governments Across continents, cattle shelters and sanctuaries support animal welfare but face late illness detection, climate stress, high costs, and rising climate-reporting demands. Hanumayamma Cow Necklace Sensors deliver 24×7 AI monitoring, early illness alerts, climate insights, and COP21-aligned methane tracking for global cattle care.

Research Laboratories

Research Laboratories Across the Himalayan Kashmir Valley, AI-powered Cow Necklace Sensors enable continuous cattle health monitoring, climate-stress detection, productivity gains, methane reduction, and sustainable farmer livelihoods.

Producers & Food Processors

Producers & Food Processors AI-driven specialty crop intelligence for processing tomatoes integrates climate analytics, price forecasting, and risk modeling to optimize farm decisions, stabilize processor procurement, reduce food waste, and strengthen global food security across volatile agricultural markets.

Predictive Analytics - Commodity Prices

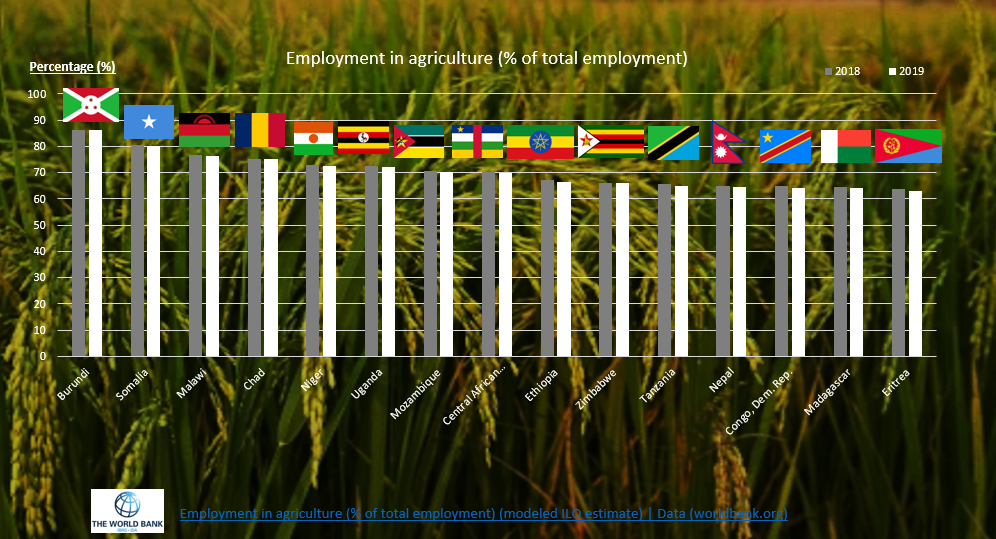

Predicting commodity prices is important for making decisions about how much land to plant and harvest crops on and for the economic health of small farmers. Anticipated prices of agricultural commodities can impact how much land farmers and ranchers use for crops or how many animals they keep and, therefore, affect the availability of agricultural commodities.

Farms’ financial health is also affected by commodity price changes. For example, when commodity prices stay low for a long time, farms have less income and need to borrow more money, which makes them more exposed to higher interest rates and other economic changes. When commodity prices stay high for a long time, farms have more income and more capacity to deal with economic changes. Commodity price changes also matter for food security: when prices stay low for a long time, consumers can afford to buy enough food, but when prices stay high for a long time, their food security is reduced, especially in developing countries.

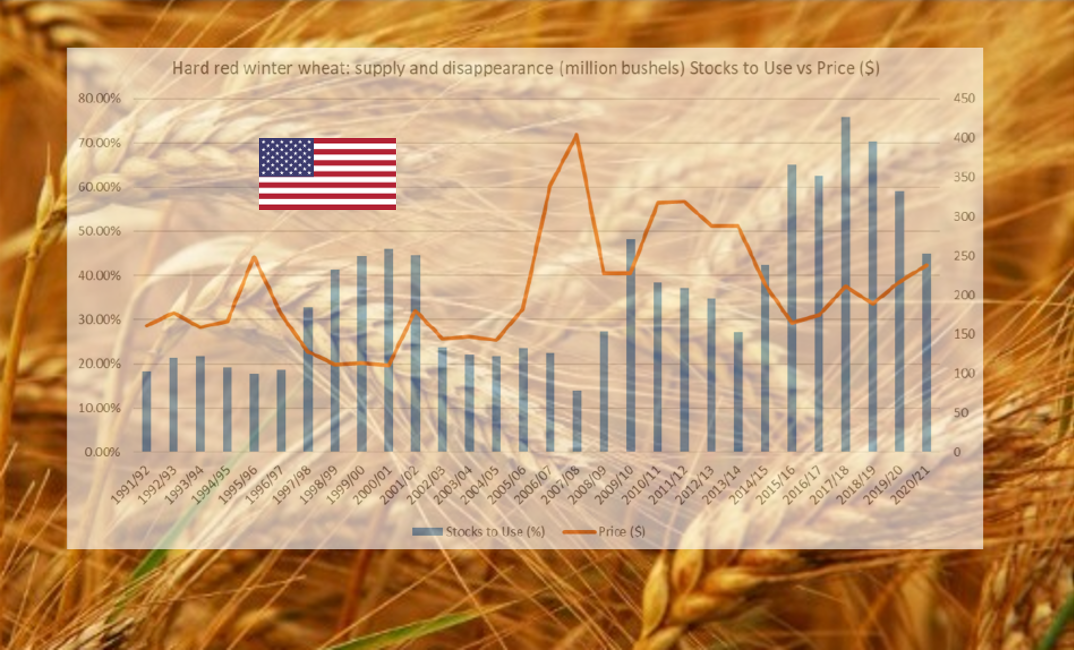

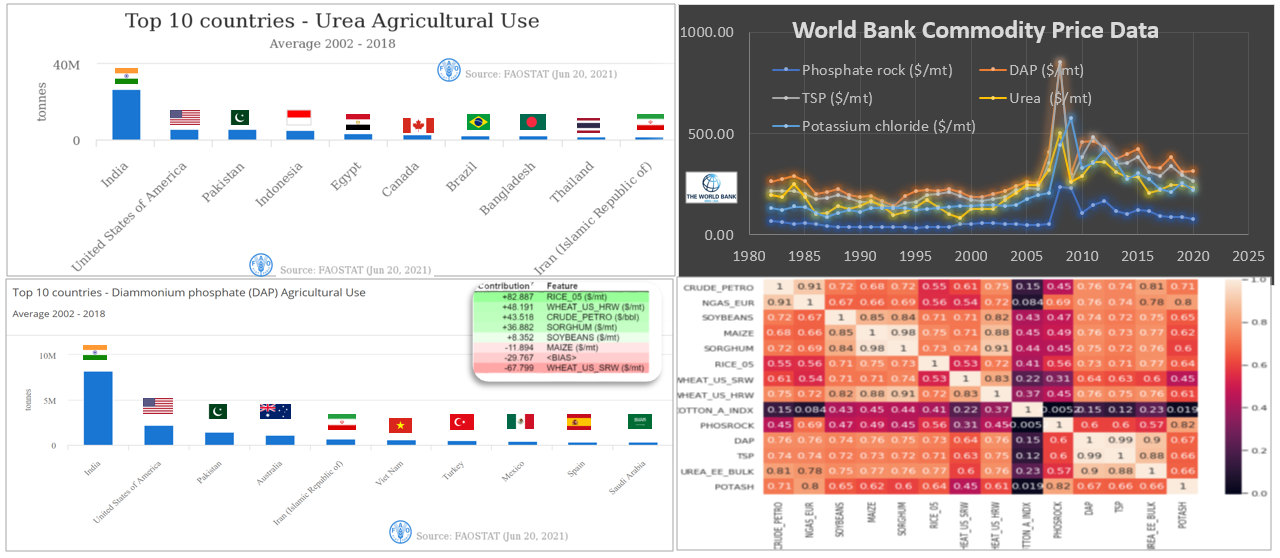

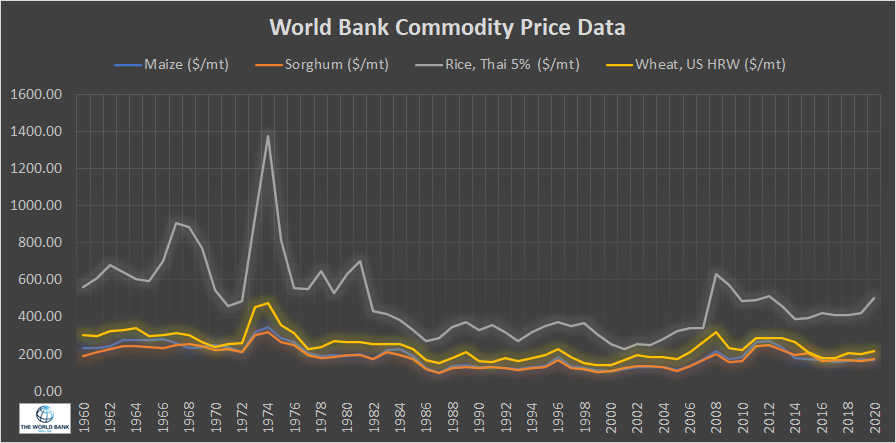

Agricultural product prices behave in a unique way and need special attention. Agricultural Commodity Markets respond to macroeconomic factors, oil prices, demand/supply, consumer preferences, bad weather, biofuels, stock to use ratios, dollar exchange rates, speculation, food storage, speculative activity, financial markets, fertilizers, trade barriers, national wealth, and other economic situations. Economic growth, Money Supply, Weather, and Inflation increase the commodity prices (bubbles), while interest rate lowers them.

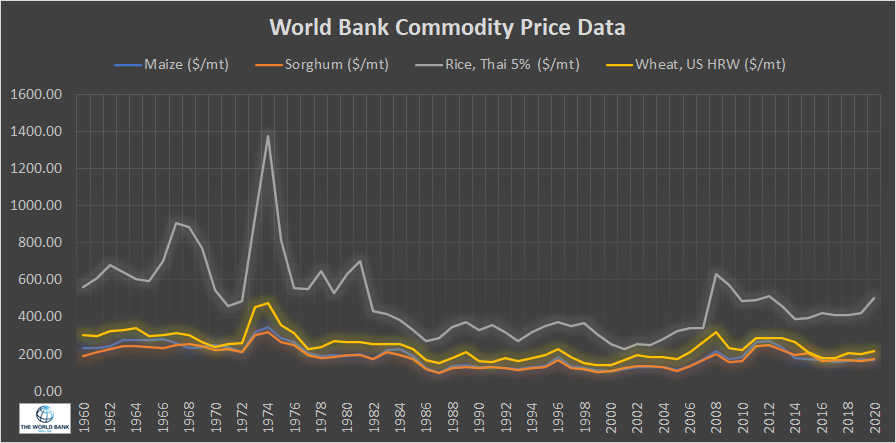

Commodity Markets Source: The World Bank

Commodity Markets Source: The World Bank

Hanumayamma Analytics platform examines the credit from agriculture in more than 120 countries on how much private/commercial banks lend to agricultural, forestry and fisheries producers, including households, cooperatives and agro-businesses. Forecasting commodity prices is difficult and requires data science & econometrics together with macroeconomic factors, government rules, subsidies, imports/exports, production and demand. Using econometric analysis, advanced statistics, machine learning and artificial intelligence helps to understand price transmission, correlation and causality.

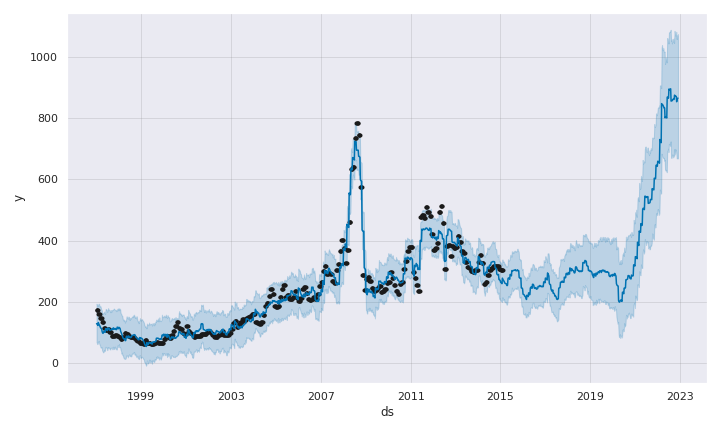

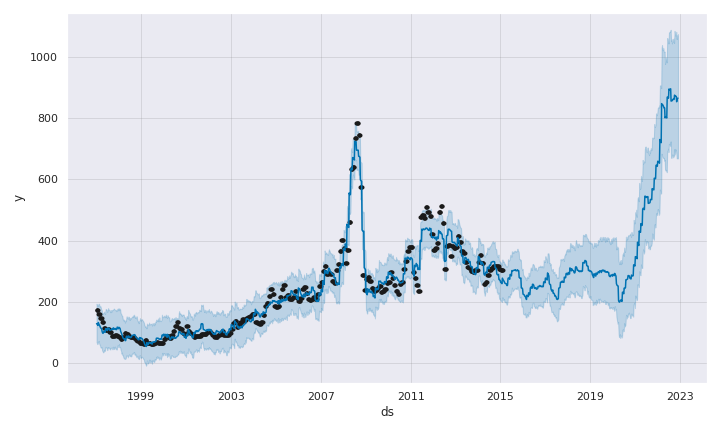

Time Series Pricing Model - Urea Predictive Model

Time Series Pricing Model - Urea Predictive Model

Hanumayamma Machine Learning Platform constantly examines macroeconomic factors, major business market indicators, demand & supply dynamics, Weather, Climate Change, and other market influencing indicators to anticipate the trends of Urea prices and help small farmers increase their profits. Please click request demo to speak with our sales and data science teams.

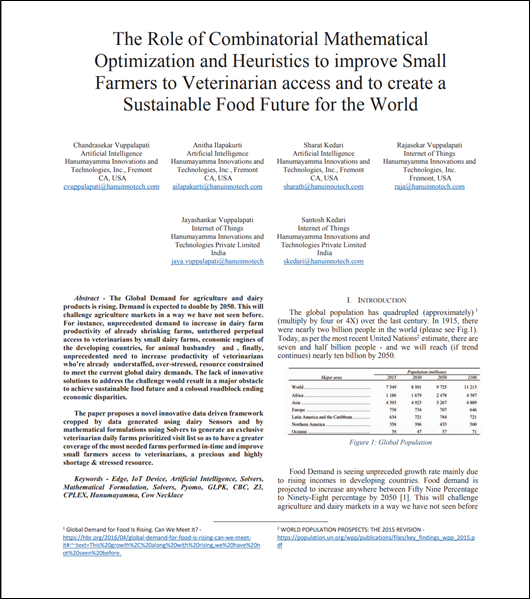

More on Democratization of Artificial Intelligence for creating a sustainable food future, please check our published thought leadership paper:

More on the role of combinatorial mathematical optimization and Heuristics, please check our published thought leadership paper: